capital gains tax increase 2021

The tax hike would apply to households making more than 1 million. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Basic rate payers and higheradditional rate payers.

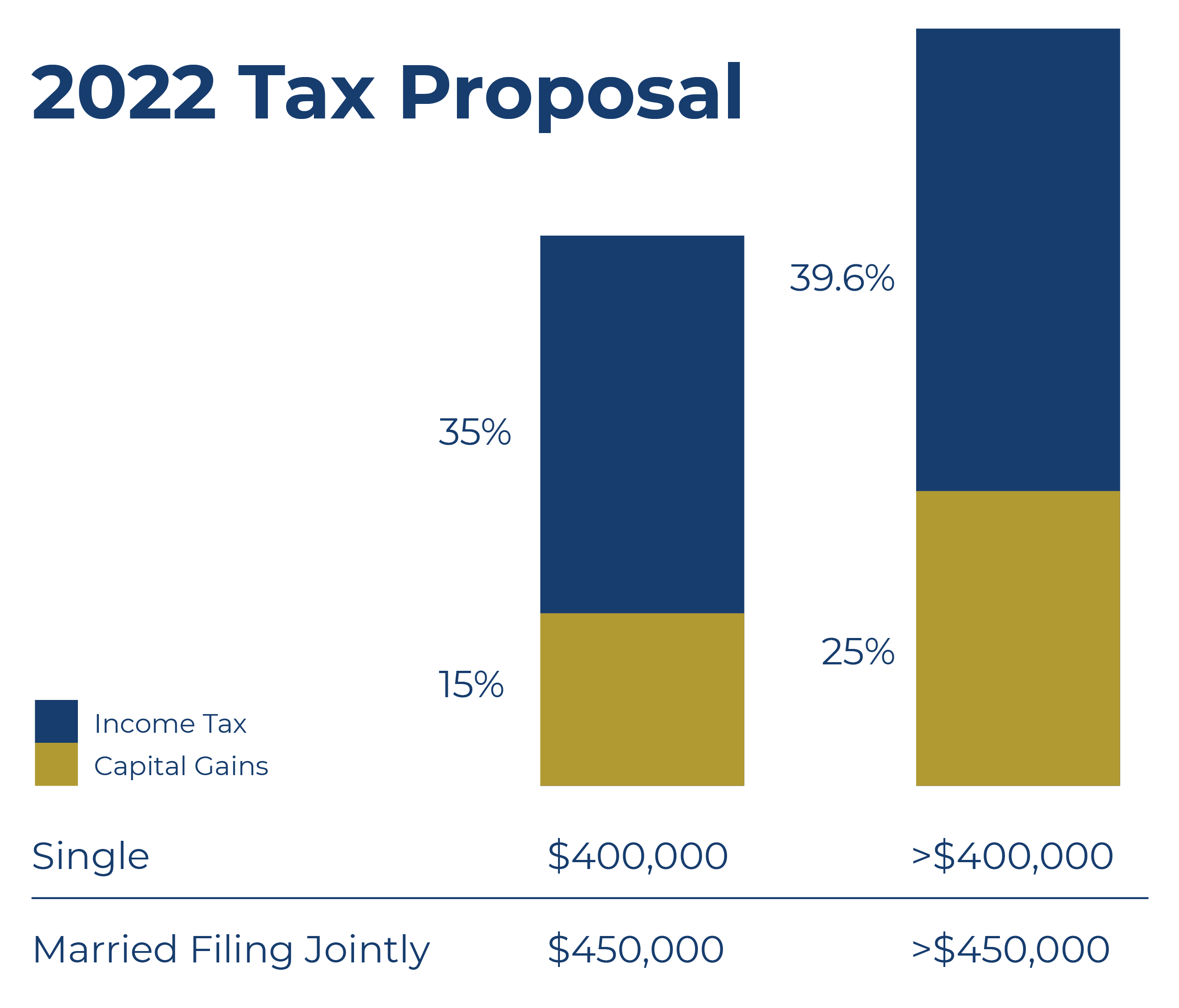

. If this were to. House Democrats propose raising capital gains tax to 288 House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20.

Apr 23 2021 305 AM. The dividend tax rates for 202122 tax year are. 75 basic 325 higher and 381 additional.

CGT rates differ from income tax rates and are in two broad brackets. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or. The top rate would jump to 396 from 20. Posted on January 7 2021 by Michael Smart.

However it was struck down in March 2022. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Will capital gains tax go up in 2021.

This means that high-income investors could have a tax rate of up to. Over the 20202021 tax year the basic rate on. Capital gains tax increase 2021 uk Sunday February 27 2022 Edit.

The proposal would increase the maximum stated capital gain rate from 20 to 25. This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell. Capital Gains Tax Rates 2021 To 2022.

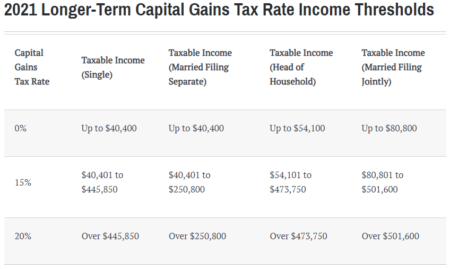

Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Weve got all the 2021 and 2022 capital gains. To address wealth inequality and to improve functioning of our tax. 2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe.

Capital gains tax is likely to rise to near 28 rather. While it is unknown what the final legislation may contain the elimination of a rate. As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate.

The effective date for this increase would be September 13 2021. What is the dividend tax rate for 2021. Its time to increase taxes on capital gains.

CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. President Biden will propose a capital gains tax increase for households making more than 1 million per year.

By Charlie Bradley 0700 Thu Oct 28 2021.

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Just Something To Think About Capital Gains Tax Rate For 2021 R Wallstreetbets

Capital Gains Tax Hike No Gains No Fairness Hoover Institution Capital Gains Tax Hike No Gains No Fairness

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

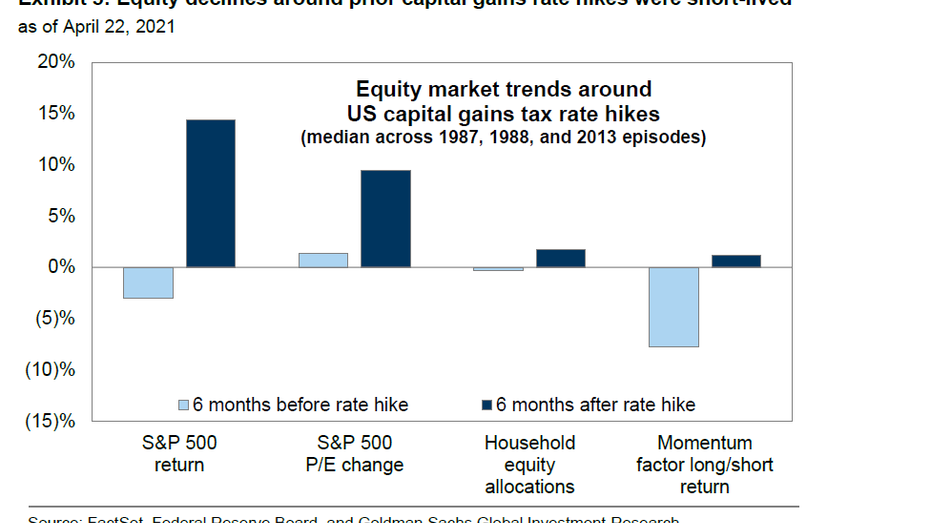

Capital Gains Tax Hikes And Stock Market Performance Fox Business

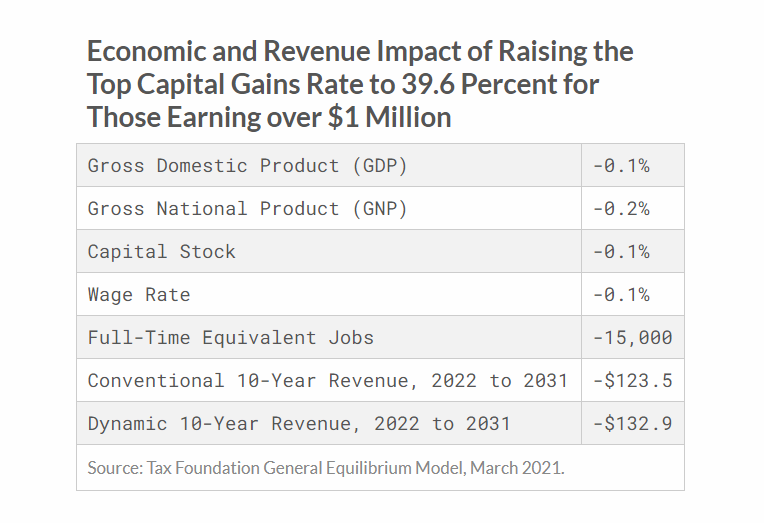

Tax Foundation On Twitter Raising The Top Capital Gains Tax Rate To 39 6 Percent For Those Earning Over 1 Million Would Reduce Federal Revenue By About 124 Billion Over 10 Years According

How To Avoid Paying Capital Gains Tax Legally Capital Advantage

Capital Gains Tax In The United States Wikipedia

Why A Capital Gains Tax Increase Would Be A Massive Jobs And Wealth Killer Foundation For Economic Education

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

How To Pay 0 Capital Gains Taxes With A Six Figure Income

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax Archives Skloff Financial Group

American Families Plan Tax Proposal A I Financial Services

House Democrats Capital Gains Tax Rates In Each State Tax Foundation